How do you do bookkeeping on Google Sheets?

The hard truth about owning a small business is that bookkeeping is one of those tasks that you can only push off for so long.

Yet, bookkeeping is the task that I often see get pushed to the back burner until you can’t avoid it anymore (aka those tax season scaries hit you hard in January).

Part of why this task gets pushed aside by so many small business owners is that there is massive talk and pressure about getting it done, but everyone points you to an intimidating software or says you have to hire a bookkeeper. I get that not everyone is at that point in their business, and there is NOTHING wrong with that. Those are not your only two options.

I’m not going to tell you that you NEED a bookkeeper, but I will tell you that you NEED to do your bookkeeping.

When you first start your business, you are probably thinking, “I don’t want to pay for a bookkeeping software (or learn how to use it), I can’t afford a bookkeeper, AND I know I still need to get my income and expenses in order, so WHAT THE HECK DO I DO?!”

*insert freeze response*

Now tax season is at your door step, your accountant asks for your business documents, and all you have to show are some bank statements (psst… bank statements ≠ bookkeeping). And the next year, you tell yourself that it WILL NOT happen again.

There are so many additional benefits to having your bookkeeping up to date throughout the year instead of just gathering everything at tax season.

Knowing your numbers - it is easy to THINK we know what is happening in our business bank account, but to actually see those numbers is a different story. The reports you can get from your bookkeeping is powerful information.

Not missing important deductions - when you look at your business statement 7 months after the fact, there is a good chance you do not remember what that trip to target for $31.23 was for (unless you are crazy good at keeping your receipts). Setting aside time each month means those purchases are fresh in your mind. Because let’s be honest, sometimes I barely remember what I ate for lunch yesterday.

Stress-free tax season - while you may be able to gather everything in a frantic push for your accountant. Imagine if you took 30-60 minutes each month to update your bookkeeping. In January, you just have to sit down and complete Decembers bookkeeping. You can go into tax season with confidence and peace of mind!

Here is where a nifty Google Sheet for your small business bookkeeping can be a MAJOR tool if you are feeling a little intimidated by that QuickBooks Online subscription you may have just purchased.

When considering whether using a Google spreadsheet for your bookkeeping is the best fit for you, I want you to ask yourself:

How many monthly transactions do I have? (I typically recommend this for those who have very minimal transactions, I’m talking under 50 a month between all of your business accounts)

Do I have the time/capacity to enter everything each month? (With using a google sheet for your bookkeeping, there is a little more manual entry involved so you need to take that into account)

Is my business a Sole Prop or Single Member LLC? (If your LLC is taxed as an SCorp I recommend using a software to help with the complexiting of your bookkeeping - payroll, balance sheet, etc)

If you have minimal transactions, are ready to put in the time to update your bookkeeping google sheet each month, and are a Sole Prop or Single Member LLC let me introduce you to….

My favorite Google sheet bookkeeping template: The Income + Expense Tracker

This is a resource designed to help small business owners and/or contractors who know they need to get their finances organized, but just are not ready for a software (financially and/or mentally because learning how to use a software correctly takes lots of time and energy).

There are things you do NOT want to miss when it comes to recording your income & expenses for your small business and this bookkeeping google sheet covers it all. (Not to mention, this is a ONE TIME FEE you can use YEAR after YEAR!!)

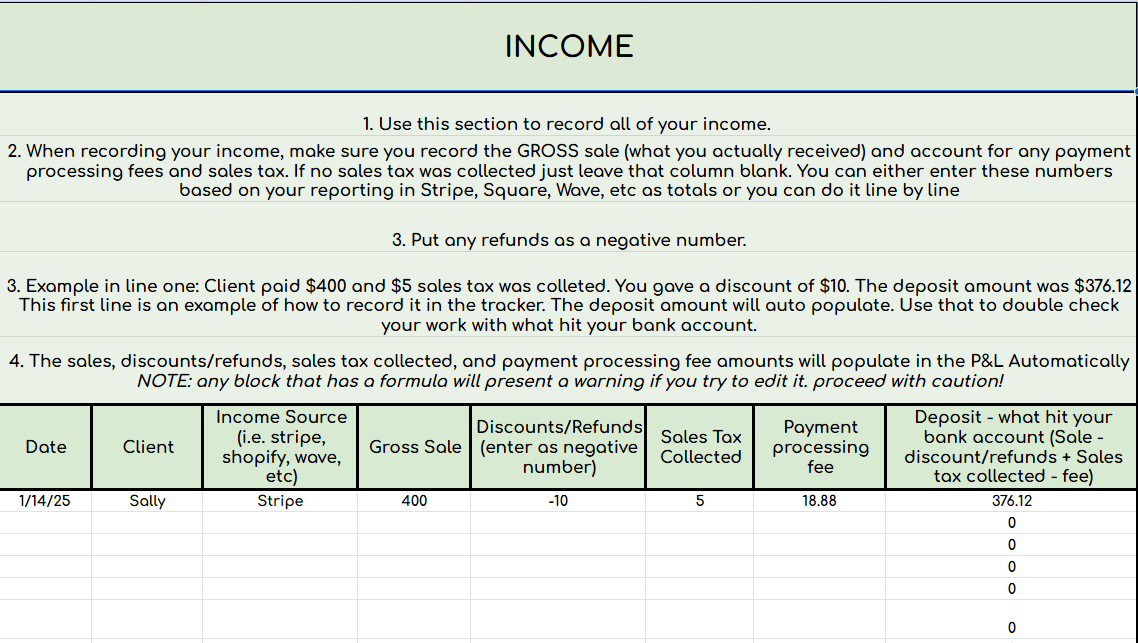

Easily track your total sales, payment processing fees, and discounts/refunds given in the Income section

This is information you will gather form your payment processors - stripe, honeybook, dubsado, whatever you are using to take payments. You do NOT want to just record the deposit that hits your bank account! Make sure to account for the gross sale, payment processing fees, any sales tax collected separately. Then you can compare the Deposit amount to what hit your bank account.

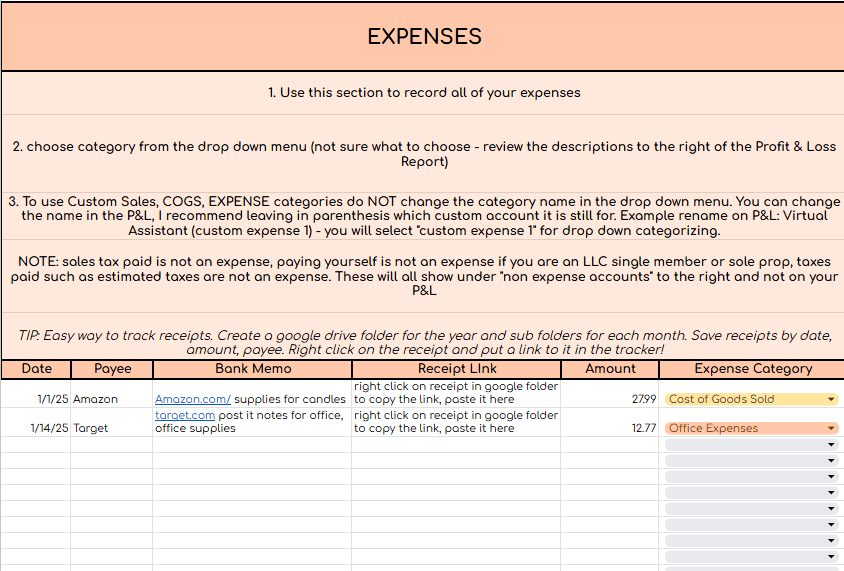

2. Record your expenses, attach matching receipts (I walk you through how to do this in my intro video if you purchase it), categorize your expenses with an easy to use drop-down menu

Each month has its own Individual tab where you will enter your income and expenses to keep you nice and organized! The easiest thing to do is to download a CSV from your bank of all of your transactions that month so you can copy/paste info!

3. Watch your Profit and Loss form as you enter in your information each month!

As you fill out each month’s income and expenses, you will see your profit and loss report for that month populate! No more guessing where your hard earned money is going.

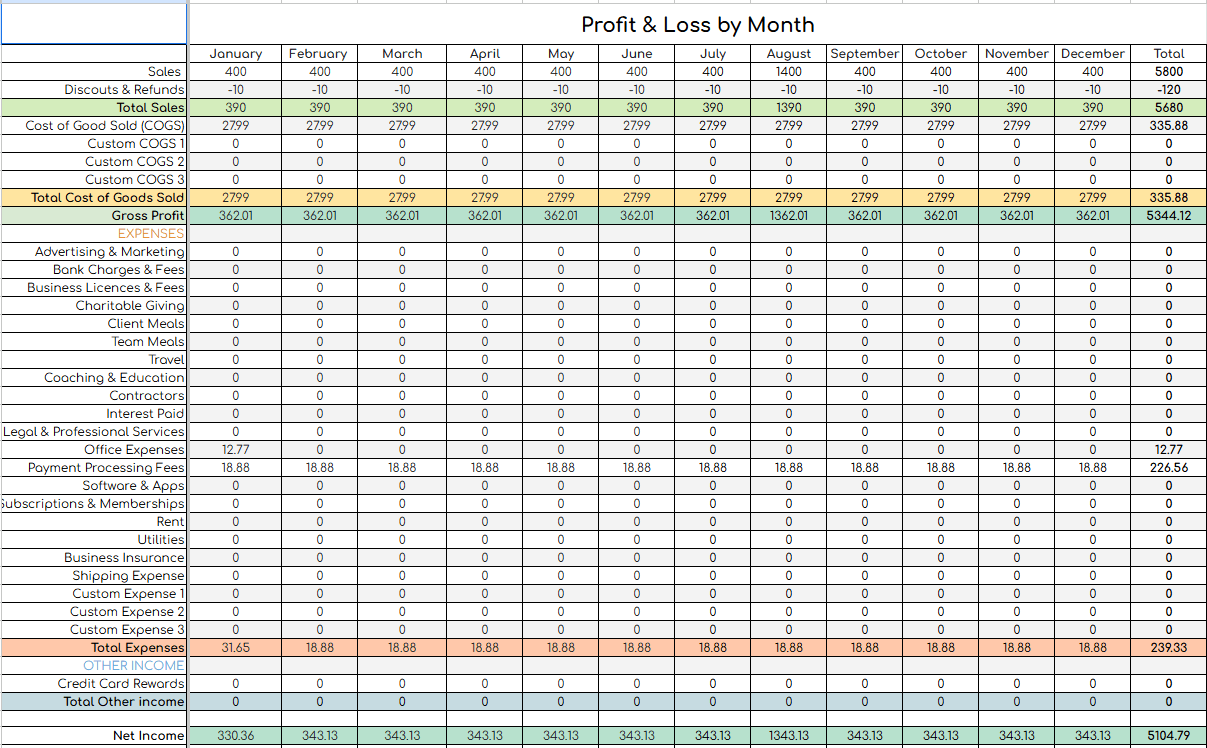

4. Compare how your business is doing month to month with an auto populating Profit & Loss by month report.

After you complete each month, you can head to the Profit & Loss by Month tab in your Google spreadsheet to compare how your business is doing throughout the year! Find trends in your busy and slow seasons, see how your business is growing, and make informed decisions!

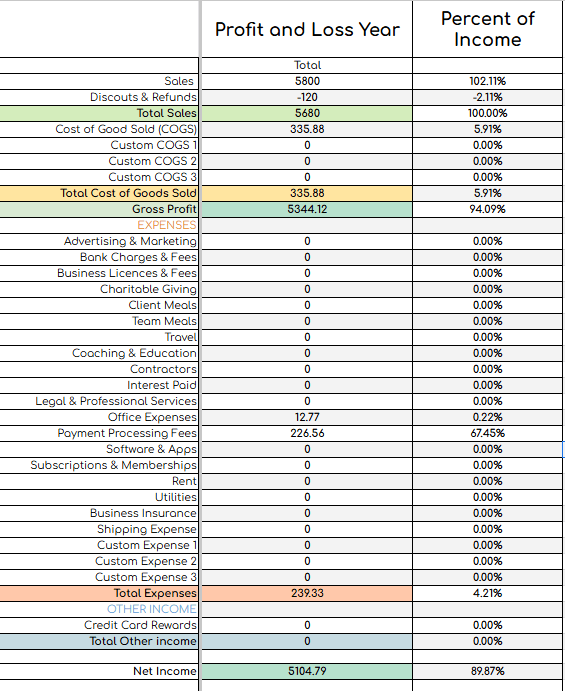

5. See where the money you are making is going with the Profit and Loss % of Income report. Seeing the percentage of your expenses compared to your income is a great visual trigger to help understand your numbers!

This is one of my favorite reports that I run for my clients in QuickBooks Online, so I knew I had to create it for my bookkeeping template. Seeing your expenses broken out as a percentage is a great tool for making financial decisions. This report is for the entire year - so as you fill out each month it will adjust!

Whether it is January, June, or November - there is no wrong time to start getting your small business bookkeeping organized. You just need to start.

Pick a system to track your finances (like my Income + Expense Tracker in Google Sheets)

Set up a date with yourself. For real - add it to your calendar and do NOT stand yourself up.

Dive in. I bet you will be surprised with how little time it takes you when you have a good system in place.

You got this! Happy organizing!

If you are looking for other ways to get your small business organized, check out some of my other Bookkeeping Google Sheet templates HERE:

Home Office Deduction Calculator | Owner Pay Calculator | Mileage & Travel Log