Easy-to-use Google Sheet Templates for your Small Business Bookkeeping!

For the small business owner who is ready to get their booty organized but not ready to tackle learning a software. With these Google Sheets, you can ditch the Excel software and easily access it from anywhere in your Google Drive!

These calculators are a one-time fee that you can use year after year!

Your small business finances are about to be so organized you won’t know what to do with your time!

“ I used your tracker, and everything felt clear, simple, and easy. Now this procrastinator is about to CONFIDENTLY turn these books into my accountant without filing a tax extension”

“I’m LOVING the google sheets tracker! ”

“I’ve bought other trackers before, and this one is far and away the best one I have encountered that I will use for years to come for my small contractor business! You literally saved my life with this, I cannot even tell you! ”

-

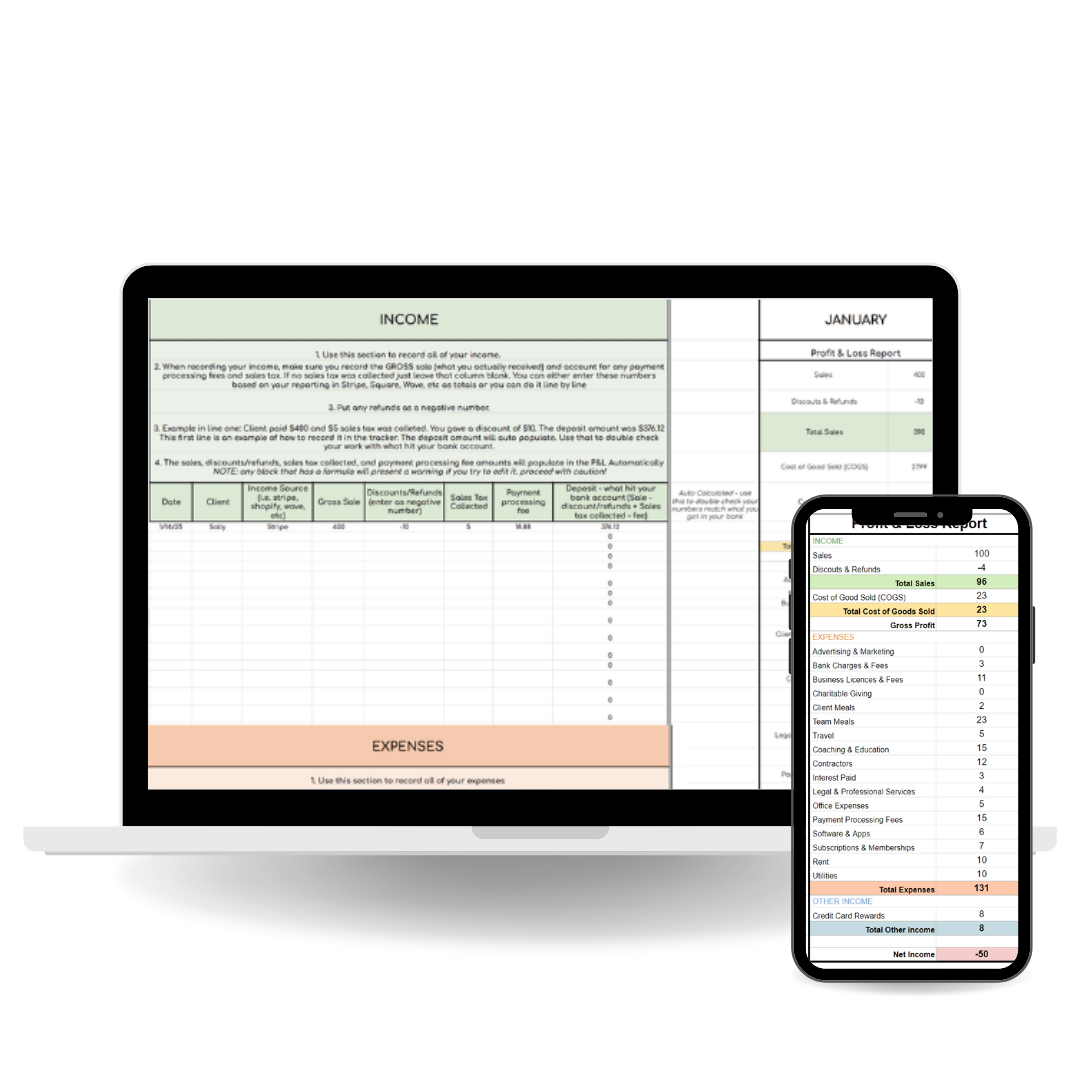

Income + Expense Tracker - $27

A google sheet you can use year after year to easily track your income + expenses. Watch your Profit and Loss report form as you fill it out!

Compare how you are doing throughout the year with a Profit & Loss by Month report as well as a Profit & Loss % of income to see where your money is going!

-

Home Office Deduction Calculator - $11

Calculate your Home Office Deduction and help you maximize your savings year after year! Don’t miss out on calculating this major deduction for your small biz!

Plus get a Cell Phone Deduction Calculator!

-

Milage Tracker & Travel Log - $7

If you are constantly using your car to drive to client meetings, pick up supplies, go to photo shoot locations, you name it - you don't want to miss out on this money saving tool!

Plus get a Travel Log! Because it is so important to keep track of any trips you take for business including where you went and what you did!

-

Owner Pay Calculator - $7

No longer wonder what to pay your self or how much to set aside for taxes. Easily estimate of what you pay yourself as a single member LLC or Sole Prop.

Common questions (and answers) about the Google Sheet Templates

-

Once you purchase the calculator you will get instant access to it via thrivecart where you will get instructions to make a copy of it into your own google drive

-

Each year you can create a new bookkeeping folder (aka Bookkeeping 2025, etc) and make a copy of the calculator. Clear out the old info from the copy and boom - you are ready to stay organized for another year!

-

I recommend using this if you have a small business with a handful of transactions each month (like under 40) - since you are doing manually entry and double checking things (reconciling) is more difficult, so I recommend it for the smaller accounts

-

You get a home office deduction for your business if you have a space that is a DEDICATED office space. So I’m not talking that you work at your kitchen table or couch. You have a desk in a room - and that is what you are using to calculate your home office!

You can deduct your home office using the simplified method (sq ft x $5) or the standard method (% of home expenses).

The standard method is what the calculator does - psst you can almost ALWAYS get more doing this method!)

-

The owner pay calculator is for small business owners that are elected as a single member LLC or sole proprietor and you are paying yourself via bank transfers. (psst.. if you are elected to be taxed as an Scorp - you should be on a payroll software such as gusto. You can use this link HERE to get $100 after you run your first payroll with Gusto!)