Paying yourself as a Single Member LLC or Sole Prop Business Owner

We started our business to break free from the 9-5, and that means we need to be paying ourselves! It can be the easiest thing for business owners to get tripped up on because they don’t want to “do it wrong.”

Paying yourself consistently is going to be the greatest habit you can create in your business. It’s going to give you the confidence to keep going. Even if some months it is $200 and some it is $4000. Get in the habit of paying yourself - and celebrate it because YOU DID THAT.

The first step to know how to pay yourself, is to know how your business is structured.

How your business is structured is going to tell you how you need to be paying yourself. These are the three most common structures your business is going to have and how you should be paying yourself.

Sole Proprietorship (Sole Prop)

This means when you are filing your taxes you are using your SSN when filling out your Schedule C and have not set up an LLC (p.s. there is nothing wrong with this - and yes, you are still legit without an LLC.)

Single Member LLC

This means you have gone through the process of setting up your LLC, and when you file your taxes you will be using your business EIN (aka your business’s SSN) when filling out your Schedule C.

LLC taxed as an Scorp

If you are structured as a Scorp - you need to be paying yourself a reasonable wage via a payroll processor such as Gusto. AKA you are a W2 employee. If you have elected to be an Scorp and are NOT on payroll - you need to reach out to someone to help you get this set up ASAP (you can send me an email & I will get you connected with someone who can help).

Note: the remainder of the blog will be talking about paying yourself as a Sole Prop or Single Member LLC.

If you are structured as a Sole Prop or Single Member LLC you are going to be paying yourself via bank transfers from your business to your personal account, this is called Owner’s Draw or Owner’s Pay

Yes - it really is that easy! The key here is going to be making sure you are taking into account what you may need to pay for taxes at the end of the year. Keep reading to see how you can calculate this!

Important Lingo to Remember:

Net Income - what is left after your expenses are taken out of your revenue (Net Income = Revenue - Expenses)

Owner’s Draw/Owner’s Pay - when a single-member LLC or Sole Prop pays themselves via bank transfer from their business account to their personal account. When categorizing your Owner’s Draw it is an equity account (which shows up on your balance sheet), not an expense that shows up on your Profit and Loss Report

Now that you know how to pay yourself as a Single Member LLC or Sole Prop, you are probably asking yourself “But HOW MUCH should I pay myself?!”

If you are a sole prop or single member LLC - you need to remember that you will be paying taxes on your profits in your business. Aka your Net Income - this is what is left over after your expenses are taken out of your sales. So when you are looking at your Net Income, you need to put a portion of that into savings for taxes and THEN pay yourself. This will save you so much of a headache come tax time, because you will have the money set aside for your taxes!

A good estimate to break down your net income to pay yourself & set aside money for taxes is the following:

Save for taxes (20-30%)

Pay yourself (50%)

Save or pay yourself the remaining

Note: this is not a one-size-fits-all formula; it is just a suggestion. It can vary from business to business based on additional deductions you may get and what state you are located in!

If you need help calculating what to pay yourself you can grab my nifty Owner Pay Calculator HERE.

So now that you know HOW to pay yourself, HOW to calculate it, let’s take a look at what the process of paying yourself each month would look like!

The hard truth you probably don’t want to hear: To truly know what to pay yourself, your bookkeeping needs to be up to date!

First, you will want to complete your monthly bookkeeping. You will need to know your numbers to pay yourself accurately. Either using a software like QuickBooks or a google sheet will work just fine (keep it simple, something is better than nothing). And if you don’t have time to DIY your bookkeeping, it may be time to outsource to a bookkeeper (like me - HI!)

Once you have your net income (aka what is left from your income after all of your expenses), you will use that number to calculate what to save for taxes and what to pay yourself.

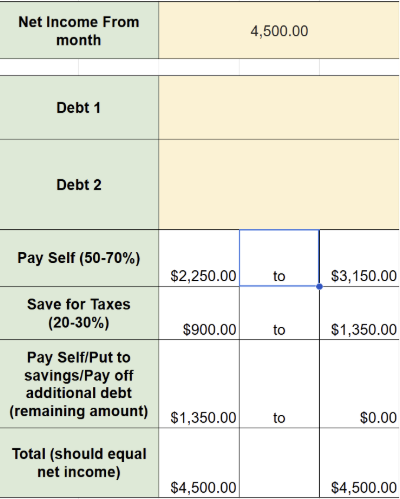

For example, using my owner pay calculator it may look something like this:

My net income for the month was $4,500

I will set aside for taxes between $900-1350

I will pay myself between $2250-3150

I will pay off additional debt, save, or pay myself what is remaining

You want to be sure the numbers you are using equal your net income for the month

I will then transfer my tax savings of $1,350

I will pay myself via bank transfer $3,150 and make a note in the memo “Owner Draw” or “Owner Pay”

Personally, I tend to over save for taxes to give myself peace of mind. Then at the end of the year if I have extra in savings, I pay myself a bonus!